The Basic Principles Of 1031 Exchange Into A Fund

Table of ContentsWhat Is 1031 Exchange California for BeginnersThe Single Strategy To Use For Real Estate Investment Companies CaliforniaFacts About 1031 Exchange Real Estate RevealedTax Shelter Real Estate for BeginnersThe Best Strategy To Use For Real Estate Investment Companies CaliforniaAll about 1031 Exchange Fund

In 2004, Congress tightened that loophole. Taxpayers can still turn trip houses into rental homes and do 1031 exchanges. Example: You quit utilizing your beach house, rent it out for 6 months or a year, as well as after that exchange it for an additional home. If you obtain a lessee as well as perform yourself in a workaday way, after that you've most likely converted the residence to an investment residential or commercial property, which should make your 1031 exchange all.

Relocating Into a 1031 Swap House If you wish to make use of the residential or commercial property for which you exchanged as your brand-new 2nd or perhaps primary residence, you can't relocate today. In 2008, the internal revenue service state a secure harbor guideline, under which it claimed it would not test whether a replacement dwelling certified as a financial investment residential property for objectives of Section 1031 (real estate investment companies in california) - go to the website.

Your individual use the house system can not go beyond the higher of 2 week or 10% of the variety of days throughout the 12-month duration that the dwelling unit is leased at a reasonable service. Additionally, after successfully swapping one holiday or investment home for another, you can't instantly transform the brand-new building to your primary home and also benefit from the $500,000 exemption.

The 9-Second Trick For Tax Shelter Real Estate

Now, if you acquire property in a 1031 exchange and later attempt to market that property as your primary house, the exemption will not use throughout the five-year duration starting with the date when the residential or commercial property was gotten in the 1031 like-kind exchange (hop over to these guys). To put it simply, you'll have to wait a lot longer to use the primary house funding gains tax break.

There is a method around this. Tax obligation liabilities end with fatality, so if you pass away without selling the building acquired via a 1031 exchange, after that your heirs will not be expected to pay the tax that you postponed paying. They'll acquire the property at its stepped-up market-rate value, as well. These rules imply that a 1031 exchange can be great for estate planning.

In the type, you'll be asked to offer descriptions of the buildings exchanged, the dates when they were recognized and transferred, any type of partnership that you may have with the other events with whom you traded residential or commercial properties, as well as the value of the like-kind properties. You're likewise needed to disclose the modified basis of the residential or commercial property quit as well as any kind of liabilities that you thought or obtained rid of.

The 1031 Exchange PDFs

If the IRS believes that you haven't played by the guidelines, then you could be struck with a large tax obligation costs and penalties. real estate investment companies in california. Can You Do a 1031 Exchange on a Primary House? Normally, a primary house does not get 1031 treatment due to the fact that you stay in that home and also do not hold it for financial investment purposes.

Can You Do a 1031 Exchange on a Second Home? 1031 exchanges put on real estate held for investment objectives. visit site. A regular holiday house will not qualify for 1031 therapy unless it is leased out and produces an income. Just how Do I Adjustment Ownership of Substitute Home After a 1031 Exchange? If that is your objective, after that it would certainly be wise not to act straightaway.

If you eliminate it quickly, the Irs (INTERNAL REVENUE SERVICE) may assume that you really did not acquire it with the purpose of holding it for financial investment purposesthe essential regulation for 1031 exchanges. What is an Instance of a 1031 Exchange? Kim owns a home building that's presently worth $2 million, double what she spent for it seven years earlier.

Excitement About Real Estate Investment Companies California

5 million. By utilizing the 1031 exchange, Kim could, in theory, sell her house structure and also make use of the earnings to help spend for the larger replacement residential property without having to stress over the tax obligation liability straightaway. She is successfully left with additional cash to invest in the brand-new property by delaying capital gains as well as devaluation regain tax obligations.

Usually, when that property is at some point offered, the internal revenue service will certainly desire to recapture some of those reductions and also variable them into the overall taxable earnings. A 1031 can help to postpone that occasion by basically surrendering the cost basis from the old residential or commercial property to the new one that is replacing it.

The Bottom Line A 1031 exchange can be used by wise investor as a tax-deferred approach to build wealth. The lots of intricate moving parts not just call for understanding the regulations yet also employing professional aid even for experienced investors.

The Ultimate Guide To What Is A 1031 Exchange California

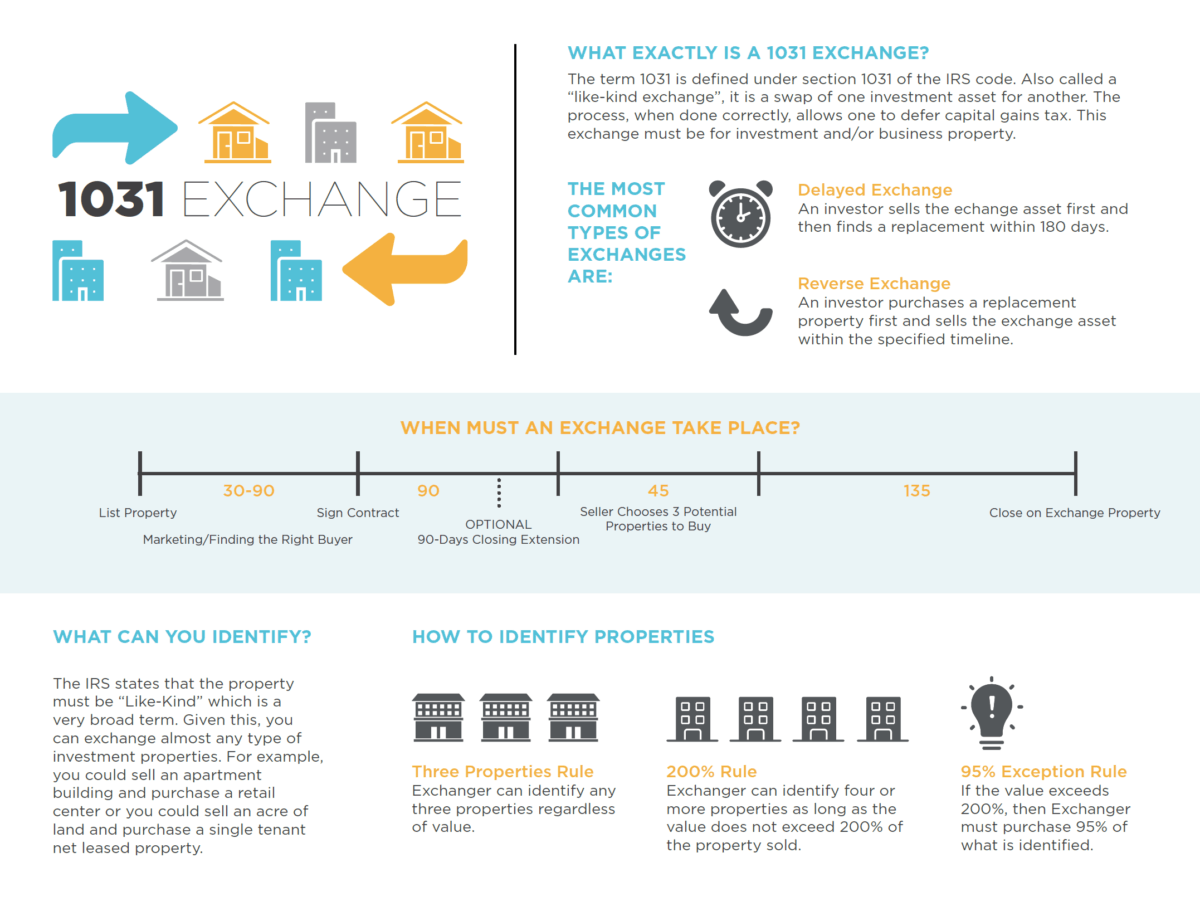

Savvy real estate financiers understand that a 1031 Exchange is a typical tax obligation method that aids them to grow their portfolios and also raise internet worth quicker and more successfully than would otherwise be possible. So what is a 1031 Exchange, just how does it function, what are the various types as well as just how Visit Website do you stay clear of usual blunders? Total the six actions listed below and also you'll learn whatever you require to find out about 1031 Exchanges.

# 1: Understand Just How the Internal Revenue Service Specifies a 1031 Exchange Under Area 1031 of the Internal Revenue Code like-kind exchanges are "when you exchange real estate utilized for service or held as an investment entirely for various other company or financial investment property that is the very same type or 'like-kind'." This approach has actually been permitted under the Internal Income Code since 1921, when Congress passed a statute to avoid taxation of recurring investments in building as well as additionally to motivate energetic reinvestment.

# 2: Identify Eligible Features for a 1031 Exchange According to the Internal Earnings Solution, property is like-kind if it's the very same nature or personality as the one being changed, even if the quality is different. The IRS considers realty building to be like-kind no matter exactly how the realty is improved.

The smart Trick of Tax Shelter Real Estate That Nobody is Discussing

That consists of products such as equipment, tools, art work, collectibles, patents and intellectual home (browse this site).